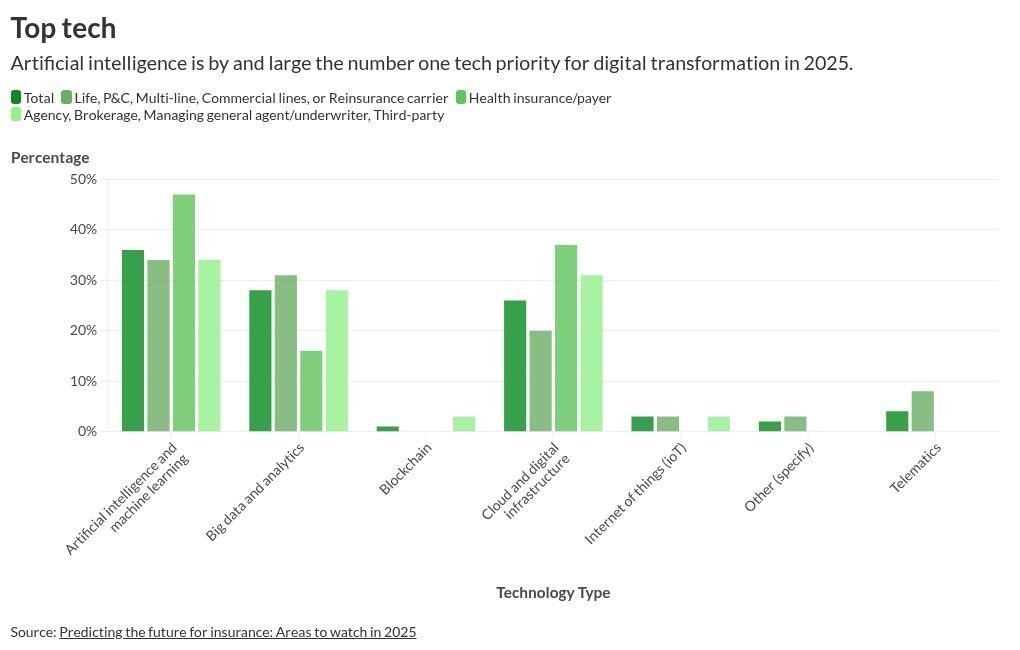

The insurance industry is evolving rapidly with the integration of technology, and 2025 promises to be a year of major transformation. From Artificial Intelligence (AI) to Big Data and the gradual but cautious adoption of new tech, insurers are stepping into an era where innovation and customer expectations collide. This article delves into the insurance technology trends shaping 2025, how AI and Big Data are revolutionizing the industry, and why cautious adoption is critical in navigating these changes.

1. Artificial Intelligence (AI): Redefining Insurance Processes

The Growing Role of AI in Insurance

By 2025, Artificial Intelligence will be a cornerstone of the insurance industry. AI’s ability to analyze vast amounts of data, make decisions faster than humans, and continuously improve from new inputs will lead to more personalized and efficient services.

AI in Underwriting and Pricing

AI-powered systems will automate many aspects of underwriting, including risk assessment, policy pricing, and fraud detection. With AI, insurers can accurately analyze historical data, customer behavior, and external market conditions to offer customized insurance plans.

- Personalized Policies: AI will create highly tailored insurance plans based on individual needs and behaviors.

- Dynamic Pricing Models: AI will enable real-time adjustments to premiums based on data inputs such as driving patterns, health behavior, or environmental factors.

Claims Processing and Automation

AI’s role in claims processing will grow substantially. In 2025, AI will fully automate the claims approval process, reducing administrative errors and increasing efficiency.

- Faster Claim Resolution: AI-driven systems will instantly assess claims, provide real-time updates, and automatically determine claim validity.

- Fraud Detection: With machine learning, insurers can detect fraudulent claims by recognizing suspicious patterns in historical data and ongoing claims.

AI Chatbots for Customer Service

AI-powered chatbots will provide 24/7 customer service, handling everything from answering questions about coverage to processing claims.

- Instant Support: Customers will engage with AI systems for immediate responses, enhancing the overall experience and customer satisfaction.

- Self-Service Options: AI will allow policyholders to manage their accounts, file claims, and adjust coverage details, all without human intervention.

2. Big Data Analytics: Unlocking Insights and Improving Risk Management

Big Data’s Growing Impact on Insurance

Big data analytics has the potential to change how insurers assess risk, offer personalized products, and forecast future trends. By 2025, insurers will be able to process and analyze massive amounts of structured and unstructured data, ranging from social media activity to telematics data from connected devices.

Enhanced Risk Prediction and Pricing Models

Insurers will use Big Data to refine predictive modeling techniques, improving how they assess risk and determine premiums. The more data available, the more precise and dynamic insurers can be in determining rates for policyholders.

- Behavioral Data Integration: Insurance companies will integrate data from wearables, connected devices, and social platforms to create more accurate risk profiles.

- Improved Customer Segmentation: Big Data will allow insurers to create micro-segments of customers, enabling the delivery of highly customized policies at competitive rates.

Real-Time Data and Real-Time Risk Management

With the integration of real-time data through IoT devices and digital platforms, insurers will be able to monitor risks continuously and intervene proactively. This will help prevent claims and reduce losses in both health and property insurance.

- Telematics in Auto Insurance: Real-time data from telematics devices will enable insurers to assess driving behavior, offering usage-based or behavior-based auto insurance policies.

- Preventative Healthcare: In health insurance, wearables that track vital signs and behaviors will allow insurers to monitor health risks and offer incentives for healthier lifestyles.

3. Cautious Adoption of New Technologies: Balancing Innovation with Risk

While the adoption of AI and Big Data presents numerous opportunities for the insurance industry, insurers must approach these innovations with caution. Although technology offers incredible promise, there are key challenges that must be addressed before full-scale integration.

Regulatory Concerns and Compliance

The evolving nature of insurance technologies brings about complex regulatory challenges. Ensuring that AI and Big Data applications comply with industry regulations, particularly concerning data privacy and security, will be a major priority in 2025.

- Data Privacy Laws: With regulations like the General Data Protection Regulation (GDPR) in Europe and California Consumer Privacy Act (CCPA) in the US, insurers must ensure that they are fully compliant with local and international data protection laws.

- Bias in AI Models: AI systems, especially in underwriting and claims processing, can inadvertently perpetuate biases if not properly monitored. Insurers must mitigate these risks to avoid legal and reputational damage.

Data Security and Protection

As the insurance industry moves to adopt more advanced technologies, data security remains a top concern. With the growing use of Big Data, blockchain, and AI, the risk of cyber threats increases. Insurers must implement strong cybersecurity measures to safeguard customer data and maintain trust.

- Enhanced Security Protocols: Insurers will need to employ advanced encryption, multi-factor authentication, and AI-driven threat detection systems to secure sensitive data.

- Blockchain for Secure Transactions: Blockchain technology will play a key role in ensuring transparency and security in transactions, particularly in claims processing and smart contracts.

Talent and Workforce Transition

The introduction of advanced technology, especially AI and machine learning, requires a shift in workforce skills. Insurance companies will need to train their workforce to work alongside AI systems and adopt a more data-driven approach to decision-making.

- Upskilling Employees: Insurers will invest in training programs to upskill employees in data analytics, AI management, and digital technologies.

- AI-Human Collaboration: While AI will automate many functions, human expertise will remain essential in areas like relationship-building, complex decision-making, and customer service.

4. The Role of Automation in the Insurance Industry

Process Automation in Insurance Operations

Automation is set to transform the back-office operations of insurance companies. In 2025, many manual, repetitive tasks—such as data entry, document processing, and policy management—will be fully automated using AI and robotic process automation (RPA).

- Reduced Operational Costs: Automation will significantly reduce the costs associated with manual labor and human error, improving overall efficiency.

- Faster Policy Issuance: AI and automation will enable insurers to issue policies instantly, cutting down on the traditional delays associated with paperwork and human processing.

Smart Contracts and Blockchain

Blockchain technology will play a major role in smart contracts, where self-executing contracts will automatically enforce policy terms and conditions, eliminating the need for intermediaries.

- Instant Claims Processing: Smart contracts will speed up claims settlements by automating payouts once predefined conditions are met.

- Transparent and Fraud-Free Transactions: Blockchain’s decentralized ledger will provide an immutable record of all transactions, reducing fraud risks.

5. The Customer-Centric Approach: Personalized Experiences Through Technology

AI-Driven Personalization

AI-powered technologies will allow insurers to offer hyper-personalized products and services. By 2025, insurance companies will rely on AI to understand customer needs, preferences, and behaviors, delivering tailored solutions.

- Customized Insurance Plans: Insurers will create policies that reflect the unique needs of each customer, offering a level of customization never seen before.

- Dynamic Pricing: AI will allow insurers to adjust pricing dynamically based on the customer’s behavior and lifestyle choices.

Chatbots and Virtual Assistants

As part of the drive for enhanced customer service, chatbots and AI-powered virtual assistants will become essential tools in providing around-the-clock assistance to customers.

- Seamless Customer Interaction: Virtual assistants will guide customers through the process of filing claims, understanding policy details, and managing their accounts.

- Proactive Support: AI-driven assistants will predict when customers may need assistance and proactively offer solutions or reminders (e.g., policy renewal dates or claims submissions).

6. Sustainability and Green Insurance Tech

Eco-Friendly Innovations

Environmental concerns will drive the demand for more sustainable insurance products. In 2025, insurers will begin offering more green insurance policies, using technology to promote sustainability.

- Green Insurance Plans: Policies that reward customers for environmentally friendly actions (e.g., driving electric vehicles, installing solar panels, using energy-efficient appliances).

- Climate Risk Analytics: Insurers will leverage AI and Big Data to better assess climate-related risks and provide coverage for businesses and homeowners facing natural disasters.

Impact of Climate Change on Risk Assessment

Climate change is a growing concern for the insurance industry, particularly in areas prone to natural disasters. By 2025, insurers will use AI and Big Data to analyze climate data and adjust their risk models accordingly.

- Accurate Risk Models: AI-powered tools will predict and assess climate-related risks, allowing insurers to offer more accurate policies and provide coverage for areas affected by extreme weather events.

- Sustainable Business Practices: Insurers will encourage clients to adopt more sustainable practices, offering rewards or discounts for actions that contribute to environmental conservation.

Conclusion: Navigating the Future of Insurance Technology

As we approach 2025, the insurance industry will continue to embrace the transformative power of AI, Big Data, and other cutting-edge technologies. While the benefits of these technologies are vast, the industry must adopt a cautious approach, carefully balancing innovation with the need for data security, regulatory compliance, and ethical considerations.

Insurers that successfully integrate AI and Big Data will be well-positioned to offer more personalized, efficient, and secure services to customers. However, the key to success lies in navigating the complex regulatory environment, maintaining trust through data security, and ensuring that AI systems are transparent and fair.