Securing funding is one of the biggest challenges for tech startups, especially those in the early stages of development. While private investors and venture capital are common funding sources, government-backed loans provide a crucial alternative for startups seeking financial support with lower risks and favorable terms. In 2025, various federal and state programs offer funding solutions tailored to tech businesses, promoting innovation and economic growth.

This guide explores government-backed loan options for tech startups, their benefits, and how to successfully secure funding.

Why Government-Backed Loans Are Essential for Tech Startups

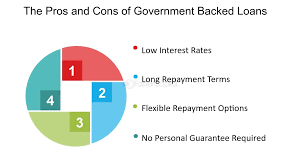

1. Lower Interest Rates and Favorable Terms

- Government-backed loans often come with lower interest rates compared to private lenders.

- Flexible repayment plans help startups manage cash flow efficiently.

2. Reduced Risk for Lenders and Borrowers

- These loans are partially guaranteed by the government, reducing lender risk.

- Startups with limited collateral or credit history have better chances of approval.

3. Encourages Innovation and Economic Growth

- Government loan programs support the tech industry to drive job creation and technological advancements.

- Special incentives for startups in AI, cybersecurity, biotech, and clean energy.

Top Government-Backed Loan Programs for Tech Startups in 2025

1. Small Business Administration (SBA) Loans

SBA 7(a) Loan Program

- Best for: General business expenses, working capital, and expansion.

- Loan Amount: Up to $5 million.

- Interest Rates: Variable and fixed rates available.

- Eligibility: U.S.-based startups with strong business plans and creditworthiness.

SBA 504 Loan Program

- Best for: Purchasing equipment, real estate, and infrastructure improvements.

- Loan Amount: Up to $5.5 million.

- Benefits: Long repayment terms and low down payments.

SBA Microloan Program

- Best for: Early-stage startups needing smaller loans.

- Loan Amount: Up to $50,000.

- Uses: Inventory, marketing, hiring, and initial operating costs.

2. U.S. Department of Energy (DOE) Loan Programs

- Best for: Startups in renewable energy, clean tech, and sustainability projects.

- Loan Amount: Varies based on project scope.

- Benefits: Supports innovation in green technologies.

3. National Science Foundation (NSF) SBIR/STTR Grants

- Best for: Research-based tech startups.

- Loan Alternative: Grants that don’t require repayment.

- Uses: R&D, commercialization, and prototype development.

4. State-Level Loan Programs

- Various states offer loan and grant programs tailored for tech startups.

- Examples:

- California Small Business Loan Guarantee Program

- New York State Innovation Venture Capital Fund

- Texas Product Development and Small Business Incubator Fund

How to Qualify for Government-Backed Loans

1. Develop a Strong Business Plan

- Outline your technology, target market, and financial projections.

- Highlight innovation and potential economic impact.

2. Maintain Good Credit and Financial Records

- A strong business credit score improves loan approval chances.

- Prepare tax returns, bank statements, and revenue reports.

3. Identify the Right Loan Program

- Research federal, state, and local funding options.

- Choose loans based on your startup’s needs and industry focus.

4. Prepare the Necessary Documentation

- Business registration and incorporation documents.

- Financial statements and cash flow projections.

- Detailed loan application with supporting evidence.

5. Submit Your Loan Application

- Follow specific guidelines for each loan program.

- Work with financial advisors or SBA-approved lenders if needed.

Alternatives to Government-Backed Loans

1. Venture Capital and Angel Investors

- Best for: High-growth tech startups seeking large funding rounds.

- Pros: No repayment required, but equity is exchanged.

2. Crowdfunding and Peer-to-Peer Lending

- Platforms: Kickstarter, Indiegogo, and LendingClub.

- Best for: Innovative products and community-backed projects.

3. Fintech and Online Business Loans

- AI-driven lending solutions with faster approvals.

- Higher interest rates but more accessible for startups.

Conclusion

Government-backed loans provide tech startups with essential funding support, offering low-interest rates, favorable terms, and reduced risks. By understanding available loan programs and preparing a strong application, entrepreneurs can secure the financing needed to fuel growth and innovation. As the tech industry continues to evolve, leveraging these funding opportunities will be key to success in 2025 and beyond.