Securing funding is crucial for tech businesses looking to scale, innovate, or sustain operations. Traditional banks can have strict requirements, making online lenders an attractive alternative. In 2025, numerous fintech companies offer flexible loan solutions tailored to tech startups and enterprises. This guide breaks down the top online lenders for tech businesses, their features, pros and cons, and how to choose the best one for your needs.

Why Choose Online Lenders for Tech Business Loans?

Advantages of Online Lenders

- Fast approval process – Get funding within days instead of weeks or months.

- Flexible requirements – Suitable for startups and businesses without long credit histories.

- Variety of loan options – Includes term loans, revenue-based financing, and lines of credit.

- Minimal paperwork – Streamlined application process using AI and automated underwriting.

Challenges of Online Lenders

- Higher interest rates – Compared to traditional bank loans.

- Shorter repayment terms – Requires quicker payback.

- Less regulation – Requires due diligence when selecting a lender.

Top Online Lenders for Tech Businesses in 2025

1. BlueVine

- Loan Types: Business lines of credit, invoice factoring.

- Loan Amounts: Up to $250,000.

- Approval Time: As fast as 24 hours.

- Best For: Startups needing working capital and cash flow support.

2. OnDeck

- Loan Types: Short-term business loans, lines of credit.

- Loan Amounts: Up to $500,000.

- Approval Time: Same-day funding.

- Best For: Small tech businesses needing quick, short-term funding.

3. Lendio

- Loan Types: SBA loans, term loans, startup loans.

- Loan Amounts: Varies based on lender network.

- Approval Time: 24-72 hours.

- Best For: Tech businesses comparing multiple loan options in one place.

4. Kabbage (American Express Business Blueprint)

- Loan Types: Lines of credit.

- Loan Amounts: Up to $250,000.

- Approval Time: Minutes to hours.

- Best For: Startups needing a flexible credit line for operational expenses.

5. Fundbox

- Loan Types: Lines of credit, invoice financing.

- Loan Amounts: Up to $150,000.

- Approval Time: 24-48 hours.

- Best For: Companies needing fast funding based on unpaid invoices.

6. Brex

- Loan Types: Corporate credit cards, venture debt.

- Loan Amounts: Varies based on business performance.

- Approval Time: Instant approval for qualified businesses.

- Best For: Tech startups looking for a banking alternative with credit options.

Comparing Online Lenders for Tech Companies

| Lender | Loan Types | Max Loan Amount | Approval Time | Best For |

|---|---|---|---|---|

| BlueVine | Credit line, factoring | $250,000 | 24 hours | Cash flow needs |

| OnDeck | Short-term loans, credit line | $500,000 | Same day | Quick funding |

| Lendio | SBA loans, term loans | Varies | 24-72 hours | Multiple loan options |

| Kabbage | Credit lines | $250,000 | Minutes to hours | Flexible credit |

| Fundbox | Invoice financing | $150,000 | 24-48 hours | Unpaid invoices |

| Brex | Credit cards, venture debt | Varies | Instant | Alternative banking |

How to Choose the Best Online Lender for Your Tech Business

1. Assess Your Business Needs

- Do you need a lump sum or revolving credit?

- How quickly do you need funding?

- What repayment terms can your business afford?

2. Compare Interest Rates and Fees

- Some lenders charge higher rates but offer more flexibility.

- Look for hidden fees such as origination or prepayment penalties.

3. Check Loan Requirements

- Some lenders require a certain credit score or revenue level.

- Determine whether collateral is needed.

4. Review Customer Feedback

- Read reviews and testimonials to ensure credibility.

- Look for complaints related to hidden fees or predatory lending.

Steps to Apply for an Online Business Loan

Step 1: Gather Your Documents

- Business financial statements.

- Tax returns.

- Revenue projections.

- Business plan (if applicable).

Step 2: Choose a Lender and Submit an Application

- Compare lenders based on your needs.

- Fill out the online application with required details.

Step 3: Review Loan Terms and Accept the Offer

- Read the fine print on interest rates and repayment terms.

- Ask about prepayment penalties or other hidden fees.

Step 4: Receive Funding and Use It Wisely

- Most online lenders transfer funds within 24-72 hours.

- Use the loan strategically to support growth and innovation.

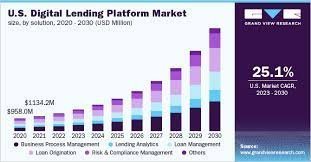

Trends in Online Lending for Tech Businesses in 2025

1. AI-Driven Loan Approvals

- Faster decision-making using machine learning.

- More accurate risk assessment based on data patterns.

2. Expansion of Alternative Financing

- Growth in revenue-based financing and blockchain lending.

- More fintech companies offering customized funding solutions.

3. Increased Government and Bank Partnerships

- Collaborations between fintech and traditional banks for hybrid lending.

- More online platforms offering SBA-backed loans.

Conclusion

Online lenders are a game-changer for tech businesses seeking fast, flexible funding in 2025. Whether you need a line of credit for daily expenses or venture debt to scale operations, choosing the right lender is crucial. By comparing options, understanding loan terms, and strategically using funds, tech companies can secure the financial support needed to thrive in the evolving digital landscape.