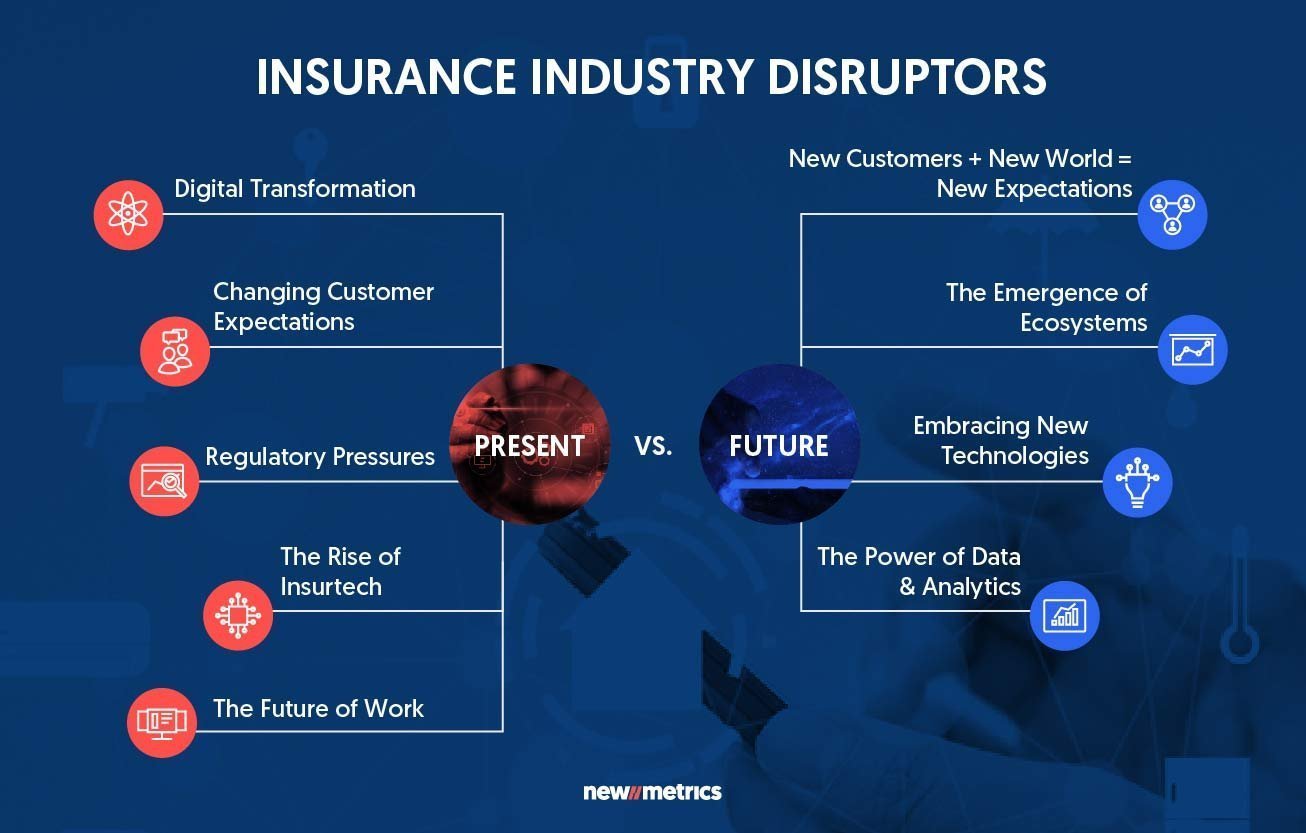

The insurance industry is on the brink of a transformative era. As we approach 2025, several global factors, from technological advancements to shifting consumer expectations, are causing significant disruption across the sector. Insurance companies are adapting to meet evolving customer needs, new regulations, and emerging risks. This article explores the major changes the insurance industry is facing in 2025 and how companies can adapt to thrive in this rapidly evolving landscape.

The Rise of Insurtech: Technology-Driven Transformation

AI and Machine Learning: Reshaping Claims and Underwriting

One of the most significant changes in the insurance industry in 2025 is the accelerated adoption of insurtech—technology innovations that merge insurance and technology. A key driver of this shift is Artificial Intelligence (AI) and Machine Learning (ML), which are making underwriting and claims processes faster, more efficient, and more accurate.

- Claims Automation: AI can now automate claims processing, significantly reducing the time it takes to approve claims. Machine learning models are also used to detect fraudulent claims, preventing financial losses.

- Underwriting Efficiency: With AI’s ability to analyze large datasets in real-time, underwriting is becoming more data-driven. Insurers are using AI to assess risk accurately and offer personalized insurance solutions.

Chatbots and Customer Service Automation

Another notable change is the use of AI-powered chatbots that help streamline customer service. In 2025, chatbots will be even more sophisticated, capable of handling complex customer queries and guiding policyholders through claims and purchases without human intervention.

- 24/7 Customer Service: Chatbots provide around-the-clock support, enhancing customer satisfaction and reducing operational costs for insurers.

- Personalized Assistance: These tools can also offer personalized policy recommendations based on customer data and preferences, fostering a more tailored experience.

The Blockchain Revolution: Improving Transparency and Security

Smart Contracts: The Future of Policy Agreements

Blockchain technology is one of the most transformative forces in the insurance industry. By providing a decentralized, secure ledger of transactions, blockchain can significantly improve transparency, trust, and efficiency in insurance operations. In 2025, blockchain is expected to be widely used in the form of smart contracts.

- Automated Claims Processing: Smart contracts will automatically execute insurance payouts when certain conditions are met. This can eliminate the need for intermediaries, speeding up claims settlement and reducing administrative costs.

- Enhanced Fraud Prevention: Blockchain’s transparency ensures that data is tamper-proof, making it far more difficult for fraudulent activities to go unnoticed.

Cross-Border Transactions and Settlements

Blockchain’s potential extends beyond fraud prevention. It also enables seamless, low-cost cross-border insurance transactions. In an increasingly globalized world, insurers can use blockchain to handle international claims without the need for intermediaries, saving both time and money.

Customer-Centric Models: Shifting Consumer Expectations

On-Demand Insurance: Flexible and Convenient

As consumer preferences continue to evolve, the demand for flexible and on-demand insurance policies is rising. Traditional insurance models, where customers commit to long-term coverage, are being replaced by more adaptable options that allow policyholders to “switch on” coverage when needed.

- Micro-Insurance: Products like micro-insurance, which offer affordable coverage for specific events, are gaining popularity. These policies allow consumers to purchase short-term coverage for incidents such as travel, health, or specific devices.

- Pay-Per-Use Insurance: Consumers are increasingly demanding “pay-per-use” insurance for various sectors, particularly auto and health insurance. Insurers will need to offer flexible, usage-based pricing to meet these demands.

Personalization: Tailoring Policies to Individual Needs

In 2025, insurers will move beyond the one-size-fits-all approach to offer hyper-personalized policies. Data from IoT devices, social media, and other sources will help insurers create highly customized products that reflect each individual’s unique needs and lifestyle.

- Data-Driven Policies: Insurers will use data analytics to design tailored coverage options. For example, auto insurance will adjust premiums based on a customer’s driving habits, such as mileage and speed.

- Behavioral Insights: Personalized discounts will be given to customers who engage in healthy behaviors, such as exercising regularly or reducing their carbon footprint.

4. The Internet of Things (IoT): Real-Time Risk Monitoring

Telematics and Smart Devices: Revolutionizing Risk Assessment

The rise of the Internet of Things (IoT) is another major change shaping the insurance industry in 2025. IoT devices such as telematics in vehicles, smart home devices, and wearables enable insurers to collect real-time data, which can be used to assess risk more accurately and personalize policies.

- Usage-Based Insurance (UBI): IoT-enabled devices, like telematics, are enabling insurers to offer usage-based auto insurance (UBI). By tracking driving behavior, insurers can offer discounts to safe drivers, while those with risky driving habits may pay higher premiums.

- Smart Homes and Property Insurance: IoT-enabled smart home devices, such as smoke detectors, water leak sensors, and security cameras, help prevent incidents by alerting homeowners to risks in real-time. Insurers can offer premium discounts to customers who use these devices, while also minimizing their own exposure to claims.

Healthcare and Wellness: A New Era of Health Insurance

In health insurance, IoT devices, such as wearable fitness trackers, will allow insurers to continuously monitor the health metrics of their policyholders. This data will not only help reduce fraud but also encourage healthier lifestyles.

- Data-Driven Health Policies: Insurers can offer lower premiums to customers who demonstrate healthier habits, such as regular exercise, maintaining a healthy diet, or staying smoke-free.

- Preventive Care: With IoT, insurers will focus more on preventive healthcare, encouraging policyholders to take proactive measures before health issues become serious and costly.

Cybersecurity: Addressing the Growing Threats

The Need for Cyber Insurance

As digitalization accelerates, the risk of cyberattacks has become one of the biggest threats to businesses and individuals. In 2025, cybersecurity will be a major focus for the insurance industry, leading to a surge in demand for cyber insurance products.

- Data Breach Coverage: Companies will seek cyber insurance to protect against data breaches, ransomware attacks, and other online threats.

- Personal Cyber Insurance: Consumers will increasingly look for personal cyber policies that protect against identity theft, fraud, and digital asset loss.

Advancements in Cyber Risk Modeling

Insurers will leverage AI and big data analytics to assess cyber risk more accurately. By analyzing vast datasets of cyber incidents, insurers will be able to offer more competitive and precise premiums for both individuals and businesses.

Sustainability and Environmental Risks: Adapting to Climate Change

The Growing Need for Climate Risk Insurance

In the face of climate change, the insurance industry is under pressure to adapt. Extreme weather events such as floods, wildfires, and hurricanes are becoming more frequent and intense, leading to a rise in insurance claims. In 2025, insurers will need to embrace new technologies to assess and price environmental risks more accurately.

- Climate Risk Models: Insurers are using predictive models to assess the likelihood of climate-related events. By integrating data from satellites, weather stations, and AI, insurers can more effectively price coverage for weather-related risks.

- Green Insurance Products: Insurers will also introduce green insurance products that encourage eco-friendly practices. These may include policies that reward consumers for adopting renewable energy, electric vehicles, or sustainable construction practices.

The Role of Environmental, Social, and Governance (ESG) Factors

In line with broader global sustainability goals, insurance companies are integrating Environmental, Social, and Governance (ESG) factors into their decision-making processes. Companies with a strong ESG focus are likely to see growing demand from investors and customers who prioritize ethical practices.

Regulatory Changes: Navigating an Evolving Landscape

Adapting to New Regulations

As the insurance industry faces rapid technological and environmental changes, regulators are introducing new rules to ensure transparency, consumer protection, and financial stability. In 2025, insurers will need to be agile in responding to these evolving regulations.

- Data Privacy Laws: With increased data collection and sharing, insurers must comply with stricter data privacy laws, including GDPR in Europe and similar regulations in other regions.

- Solvency and Capital Requirements: Regulators will also impose stricter solvency requirements to ensure that insurers can handle large-scale risks, especially with climate-related claims on the rise.

Embracing RegTech: Technology to Ensure Compliance

To manage the growing regulatory complexity, insurers will increasingly adopt Regulatory Technology (RegTech) tools. These solutions help insurers streamline compliance processes by automating reporting, monitoring, and audits.

The Future of Insurance Distribution

Digital Platforms and Partnerships

In 2025, the way insurance is distributed will also undergo a major shift. Digital platforms, including online brokers, comparison sites, and direct-to-consumer sales models, will dominate the market. Insurers will also form strategic partnerships with non-insurance companies to expand their reach.

- Embedded Insurance: A growing trend is embedded insurance, where policies are integrated into the purchase of other products, such as travel bookings or car purchases, making it easier for consumers to opt-in to insurance coverage.

Direct-to-Consumer (D2C) Sales

The rise of digital insurance platforms is driving the shift toward D2C sales models. Consumers will increasingly bypass traditional agents and brokers to purchase insurance directly from online platforms, where they can quickly compare policies and prices.

Conclusion

The insurance industry is undergoing major transformations as we approach 2025. From the rise of insurtech and blockchain to changing customer expectations and new regulatory frameworks, insurers are adapting to meet the demands of a rapidly evolving landscape. Those who embrace technology, prioritize sustainability, and innovate in response to consumer needs will lead the way in this exciting new era of insurance.